Provides security and stability.

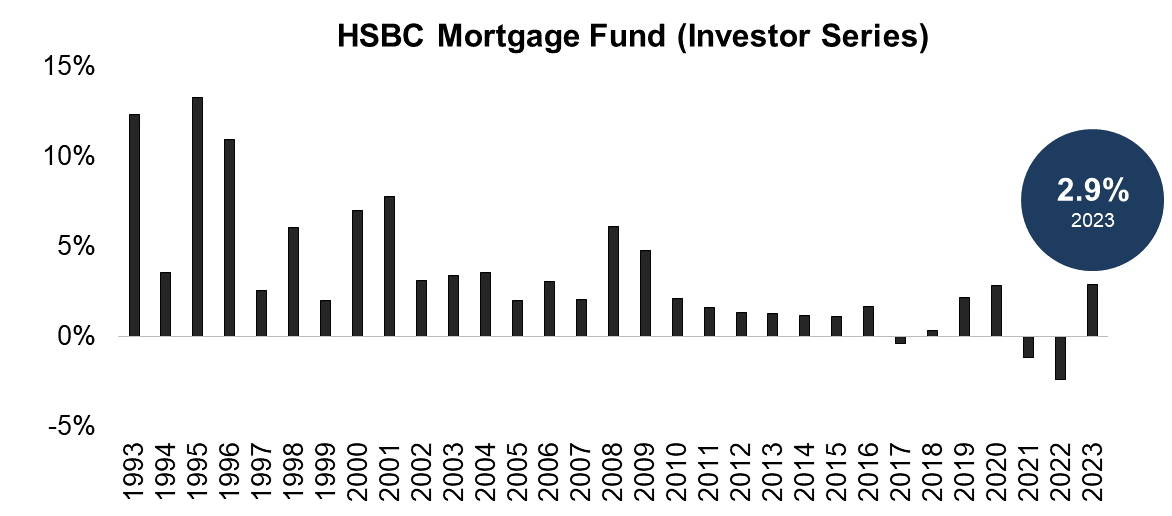

The strategy has a proven history of strong capital preservation over the long-term with only three years of negative returns since inception.

Investor series units have been available since the fund's inception and are subject to a higher management fee than Institutional series units. This chart provides performance of HSBC Mortgage fund, Investor series. VPI Mortgage Pool is being managed using the same investment methodology as HSBC Mortgage Fund. 2023 is YTD as of December 31, 2023 and for all other years ended December 31. Source: HSBC Global Asset Management (Canada) Ltd.

Protection from non-performing mortgages.

The strategy buys and sells mortgages to and from RBC Indigo (and affiliates). If any mortgage purchased from RBC Indigo is in default for 90 days or more, RBC Indigo repurchases those mortgages from the fund.